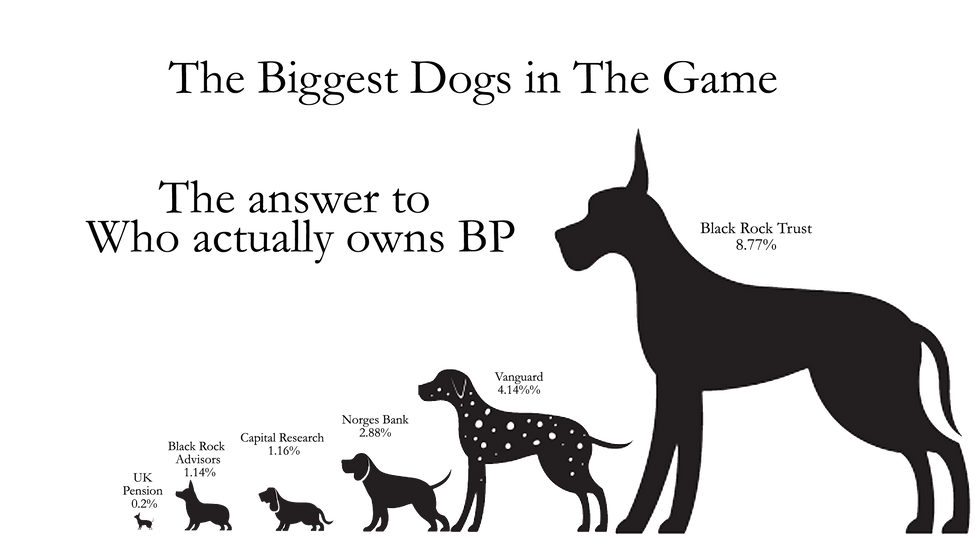

The oil company' owners by size - as if they were dog breeds. See graphic below

BP's profits more than doubled to $6.2bn (£5bn) in the first three months of the year. That compares with $2.63bn the same time last year.

Profits like that drive the UK economy, provide employment and return for investment. But what is unusual about these profits, is that they more or less fell into the lap of the company. It cost them the same amount to extract the oil and gas - but because of the war in Ukraine and the row over Russian oil, gas prices have gone through the roof. So profits at BP and others have followed - even though the company hasn't done much to generate the extra value themselves.

There has now been a call for a windfall tax on the oil sector - to help fund the huge government spending that came out of Covid and may be needed in any coming recession.

The counter argument, put forward by some, is that we all own BP and its peers through our pensions. So taxing the companies, is just a way of indirectly hurting ourselves.

It sounds like that might be a compelling argument. But it's a lot more complicated than that and the facts might not back that view up at all.

Research by the Common Wealth think tank, implies that UK pension funds hold a tiny, tiny fraction of BP - 0.2% in fact. The rest is owned by foreign funds and other collective investment groups. (See dog chart below)

On the face of it - it looks like UK pension funds hold just 0.2% of BP directly - the smallest dog on the left.

The true and full picture however is complicated by the fact that UK pension funds might hold a very small fraction of shares directly but may have ownership of the company through other investments they have in funds which themselves own a slice of BP.

The lesson of the 2008 crash, is that it is almost impossible to untangle who owns what, until trouble hits and we see the effect of a crisis run through the system.

Nonetheless, the Common Wealth think tank believes that even taking into account this further layer of complication, UK pensioners are not highly invested in BP and that the funds which do hold BP shares, have their risks so well spread - that a windfall tax on BP would not significantly affect the funds or UK pensioners.

This is not just a financial story, as oil giants are always politically and morally divisive companies and people will use whichever evidence supports their case. The numbers are complex and can be misleading. So hopefully my attempt to give you a guide to the ownership as compared to red relative size of dogs, (UK pensioners are the handbag sized dog) helps give you an immediate sense of the proportion of UK pension funds directly invested in BP.

The morality of whether oil companies should be taxed further - of course is a completely separate question.

Sources:

The 0.2% figure UK pension fund aggregate holding came from a separate ‘Fund Shareholders Report’, which is a more granular breakdown at the fund level. The 0.2% figure refers to specific funds labelled ‘pension fund portfolios’, and which are explicitly designated UK-based under the ‘country/region’ heading.

Comments