As debate over the pension income guarantee, known as the 'Triple Lock' heats up, it's worth looking at what evidence there is around pensioner poverty and the comparison between the income of pensioners and those in work.

Part of the problem is that referring to pensioners as a single group, with shared outlooks, wealth and priorities, is a massive over simplification. It's not quite like putting everyone who likes sandwiches into the same group, but it raises similar problems.

Older people are more likely to have paid off any mortgage and therefore have no housing costs. So they may need less money. Some in the age group will have very significant savings while others will have trouble making their money last to the end of the week. That's especially true for poorer pensioners, who will spend a higher proportion of their income on basic goods such as food - where inflation is now around 13% - massively outstripping the general inflation rate.

But even if we accept that making generalisations in this area is particularly problematic - it is worth just looking at what the average figures show us.

The median average income for a pensioner is £24,204 a year after housing costs while people of working age have an average income of £25,986 after housing, according to a previous report by the Resolution Foundation.

By 2026 the Foundation expects pensioners to have an average income of £24,538 a year, while non-pensioners are expected to have £24,290.

According to their figures, therefore, the average pensioner is not that significantly worse off than the average working person.

Daniel Pryor from the Adam Smith Institute, another think tank, said: “For the first time in history, pensioner incomes are overtaking those of working-age people, once you factor in housing costs.” (1)

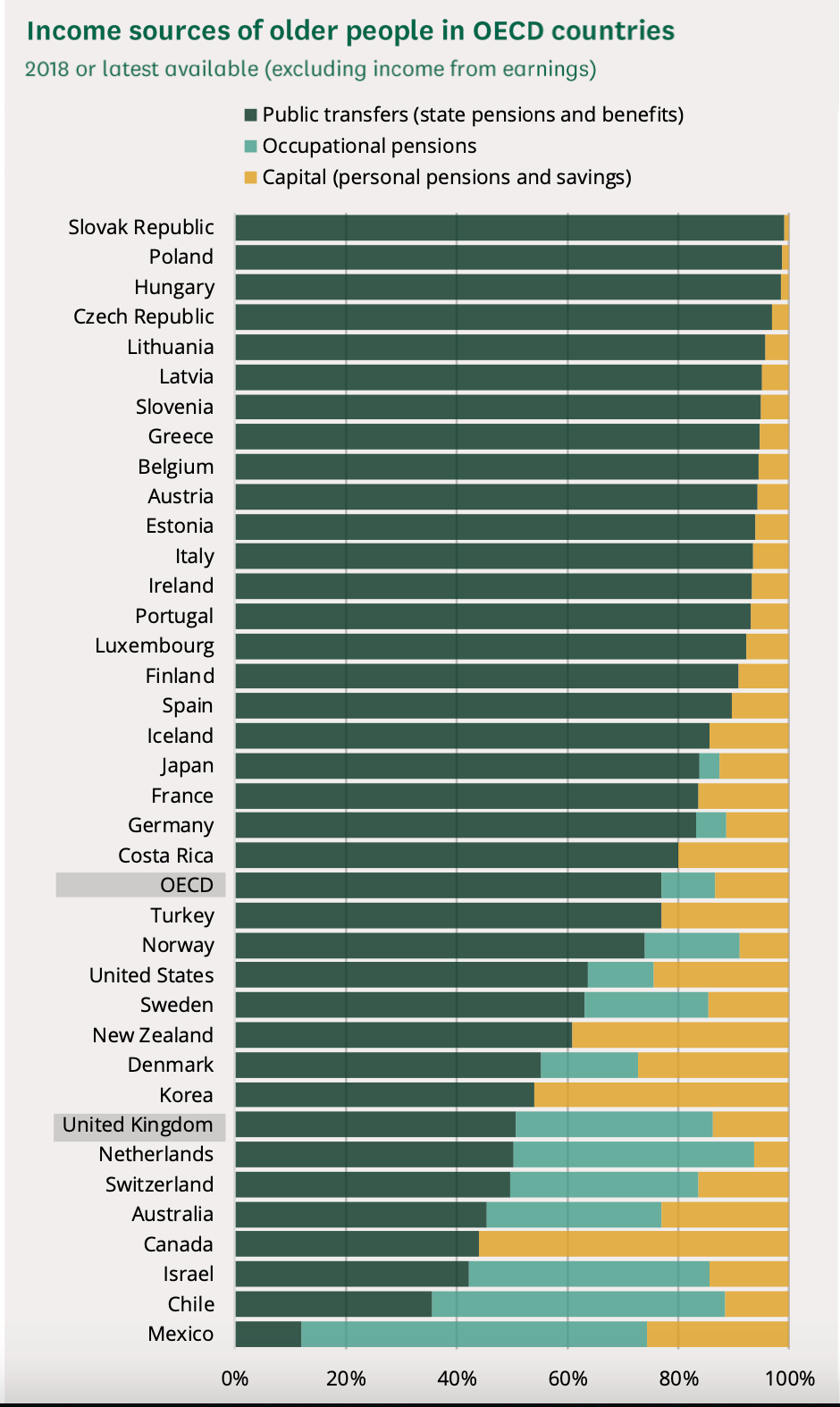

It is also worth looking at where pensioners' income comes from and how dependant they are on the state pension.

Around 50% of pensioner income (excluding earnings) in the UK comes from the state pension and benefits.

Just over a third, 36%, comes from occupational (company) pensions.

14% come from personal savings.

Compared to much of the rest of the world, UK pensioners are actually less reliant on the state pension than people in most other countries. The international comparison comes from a study by the OECD (2)

Table Source: 3

While it is true that UK pensioners seem less reliant on the state pension than many other countries, such as The Slovak Republic, Poland and Hungary - those countries are also much poorer. A fairer comparison might be between other comparatively wealthy nations. But even amongst this smaller group, UK pensioners are less dependant on the state pension than those in other countries.

Where as UK pensioners get around 50% of their income from the state pension, in Spain it is around 90%, in Norway it is around 70%, in the USA it is over 60%.

3: House of Commons Library https://researchbriefings.files.parliament.uk/documents/SN00290/SN00290.pdf

コメント